When a judgment debtor declares bankruptcy, the judgment creditor takes their place in line with unsecured creditors behind the banks and other secured interests, and that is usually the point at which we begin comparing the relative values of judgments and the paper on which they are printed.

This was the case for a client forwarder for whom we obtained judgment in Federal Court. We then faced appeal proceedings, only to have those proceedings stayed by the bankruptcy of the appellant on the eve of the appeal. The trustees for the judgment-debtor, a shipper who had made a counter-claim in Superior Court for alleged damage to unrelated cargoes, abandoned the appeal. The bankrupt had no assets and several million in paper liabilities.

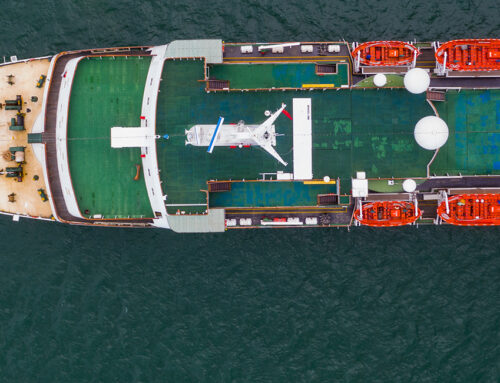

But all was not lost! Although the shipper had never actively pursued their cargo claim in Superior Court, it had been properly served and both the client forwarder and the implicated carrier had defended and cross-claimed. The underlying cargo claim involved 4 containers of perishable goods that spoiled during carriage in reefer containers, and was prima facie well-founded against the defending carrier as principal to the contract for carriage.

Our client obtained an assignment of the Superior Court claim of their bankrupt client/debtor and re-asserted it in the name of the bankrupt shipper against the implicated carrier – in the same action in which that client was also a co-defendant. On obtaining the required order to continue the action, insurers for the defendant carrier dusted off their file and came to the negotiating table, ultimately contributing more than 50% of the loss without further litigation expense.

Not a bad return on a ‘valueless’ piece of paper!

Ref:Locher Evers International v. Canada Garlic Distribution Inc. [2008] FCJ no. 388; Canada Garlic Distribution Inc. v. Locher Evers International and Evergreen Marine Corporation (Taiwan), Sup Ct. (Toronto) file no. 07-CV-331216 PD1.